Tax Season is Approaching. How Does the Recent Sweeping Tax Reform Affect You?

The tax legislation passed by Congress late last year (nicknamed the “Tax Cuts and Jobs Act”) represents significant changes to the tax code and will affect most Americans in some way. Not only were income tax brackets adjusted, but the tax rates in those brackets were reduced. The amount that you can pass down to your beneficiaries without paying estate or gift taxes rose substantially. Also business tax breaks were instituted. But there is a catch… this legislation has an expiration date.

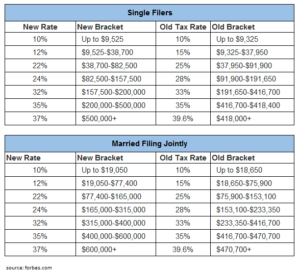

Widening Tax Brackets and Lowering Rates

As you can see, many of the tax brackets for married (and individual) taxpayers have been widened, which means you can earn more money before jumping up to the next bracket. Within most of the brackets, the rate of taxation has been decreased 1-3%.

The increase in the standard deduction ($12,000 for individuals, $18,000 for heads of household, and $24,000 for married couples filing jointly) and removal of some above-the-line deductions (moving expenses and alimony) may help save you some time at tax-time. While the bill increases the standard deduction and the child-tax credit (now worth up to $2,000 per qualifying child), it eliminates or reduces the following deductions:

- Personal exemptions

- Home equity loan interest

- State and Local taxes above $10,000

- Moving Expenses

- Casualty and theft-loss except in disaster areas

- Job expenses

- Tax Preparation fees

Luckily, the bill retains the deductions for 529 plans, IRAs, 401(k)s, and Health Savings Accounts (HSAs), offering you several opportunities to reduce your taxes while building financial security for the future if you choose to save and invest some of the tax savings.

Another aspect of the tax act that may affect you involves the penalty imposed for failing to maintain the level of health insurance mandated by the ACA. Starting January 1, 2019, the penalty for this failure will be $0.

Doubling the Tax Exemption for Gifts and Estates

Under the Tax Act, the amount a person could pass to their beneficiaries without any estate or gift taxes went from $5.49 million dollars per person to roughly $11 million dollars per person. That’s significant! This opens the door for dynasty trusts, family partnerships, discounted gifts, and other strategies that could shield a substantial amount of money for beneficiaries. However, it is important to consult an attorney now as the exemption amount could be reduced in the future by a new Congress and President.

Lowering Taxes on “Pass-Through” Businesses

A pass-through entity is a business structure that allows owners to pass income through to owners without paying tax at a business level. These include partnerships, LLCs and S corporations. Owners of such companies will now be taxed at their individual rate LESS a 20% deduction for qualified business-related income. Any business that is not operating as a pass-through entity should consider doing so to take advantage of the new rules that make pass-through entities even more attractive.

Some professional service businesses have been excluded from this deduction UNLESS they earn less than $157,500 for an individual ($315,000 for married couples filing jointly). In such a case they will also receive the tax benefit in full. Professional service business with income above that amount should consider reorganizing operations to shift income into other entities, or forming a defined benefit program.

Furthermore, business owners who reinvest heavily in the business with plans for a future IPO or other sale may consider operating as C corporations to take advantage of the new 21-percent rate (down from 35 percent) that applies to corporate income.

Final Considerations and What Can You Do

Because this tax reform has an expiration date, December 31, 2025, it would be best to consider locking in estate tax exemptions using planning strategies such as spousal access trusts, family partnerships, charitable remainder trusts and other vehicles for maintaining wealth into the future. There are many options to deal with future changes, but those strategies will only work if plans are implemented while the exemption is available. Also, it is a good time to consider establishing pass-through entities for business income. Also, if you have a Trust you should have it reviewed to make sure it takes advantage of the large estate and gift tax exemption amount. This tax reform was enacted by a Congress voting heavily along party lines. It can be expected for the pendulum to swing the opposite direction with a change in the political climate. Act now to make the most of these monumental changes.

Did you enjoy this article? Share it with your friends and colleagues.

Marianne Ludlow and Shawna Doughman Group focuses on securing your future, family & business through estate and business planning, including wills, trusts, powers of attorney, trust administration, and business planning contracts and agreements. Our offices are located in Highland and Lehi and we serve clients in Utah and Salt Lake Counties. You can contact us by phone (801) 407-6538 or e-mail [email protected].